Here is a brief look at some of the most common questions and doubts of home buyers. Q. What home can I afford? Q. Should I buy or rent? In addition, owning can be cheaper than renting plus you are free to make all decisions about upgrades, furnishings. Etc. On the other hand, property values can change and mortgage repayments can increase with rising interest rates and it may take time to sell the property. For some it may be a better decision to rent, look at how long you intend to stay in the current area. Renting can limit your choices but certainly allows more flexibility if you move around plus you are not responsible for maintenance and repairs costs. Q. Do I need to use a realtor? Q. Why should I choose a CIREBA member? Q. What is different about a home for sale by the owner? Q. How do I decide what to offer the seller? Q. Should I get a home inspection? Q. Are there inspection and valuators companies on island? Q. Can anyone own property? Q. Is there Property Tax in the Cayman Islands? Q. What is Stamp duty? Q. What should I expect for closing costs?

Look closely at current financial obligations, your income and available funds for deposit, stamp duty and closing costs. There are many Luxury homes for sale in Cayman Islands and spectacular Beachfront homes for sale but over stretching your budget can mean you forgo holidays, have reduced free cash for your lifestyle or even have issues maintaining your home. Speak with a lending provider about your finances to find a balance between what you want and what you can afford.

Home ownership is a big commitment. However, paying a mortgage is like saving for your future. The right property may increase in value in a favorable market place or you may make gains from home improvements over the time of your ownership. Ultimately, once the mortgage is paid you will own your property.

Yes, it is recommended that you use a realtor to purchase a home. Remember that realtors deal with multiple transactions throughout the year resulting in extensive market knowledge and expertise in negotiating and closing deals.

CIREBA members are highly trained and guided by a strict code of ethics. They have access to CIREBA’s MLS (Multiple Listing System) and can search through all member’s listings and Cayman Homes for Sale in one easy location. For the buyer, this means you only need to deal with one realtor for the whole process saving time and ultimately getting to you to the right property as quickly as possible.

Cayman Islands real estate for sale by owner means that the property is listed without the assistance of a real estate agent and so you would conduct negotiations directly with the seller.

Good comps and considering factors such as, what is the properties location and current condition? What are the seller’s motivations for selling? and what are the current market trends? Together with your realtor’s guidance these steps can help you put together an offer and decide if the property is the right Cayman Islands Investments for you.

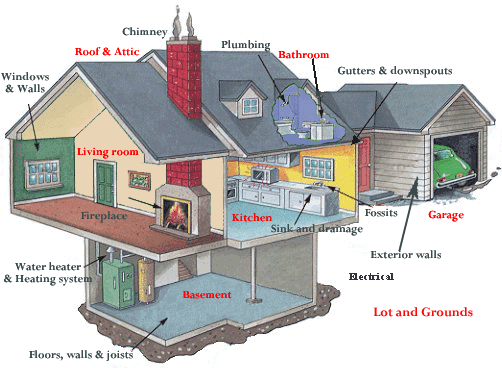

Absolutely, yes! – A home inspection shows the properties overall condition and provides an assurance of no major surprises later down the road. Where an inspection uncovers issues, your realtor can help you negotiate with the seller.

Yes, there are many reputable companies.

Yes, there is no restriction of foreign ownership and entering the Cayman Islands housing market.

No there is no property tax in the Cayman Islands, unlike other Homes for sale in Caribbean.

All homes for sale in the Cayman Islands are subject to a Stamp duty. This onetime payment is currently set at 7.5% and is calculated on the value of the property minus furnishings/chattels and is paid at the time of closing. For first time Caymanian buyers stamp duty is waived if the property is below CI$300,000 and other concessions are offered for land or higher value purchases.

When purchasing Cayman Islands houses for sale. Costs include stamp duty, plus a 1.5% duty charged on mortgages of less than CI$300,000 and 2% on mortgages of CI$300,000 or higher. It is normal to budget up to 1.5% for legal and registration fees. Your bank will require you to have a life insurance policy to cover the value of the mortgage and a property valuation which can cost from $500 and up depending on the size and type of the property.