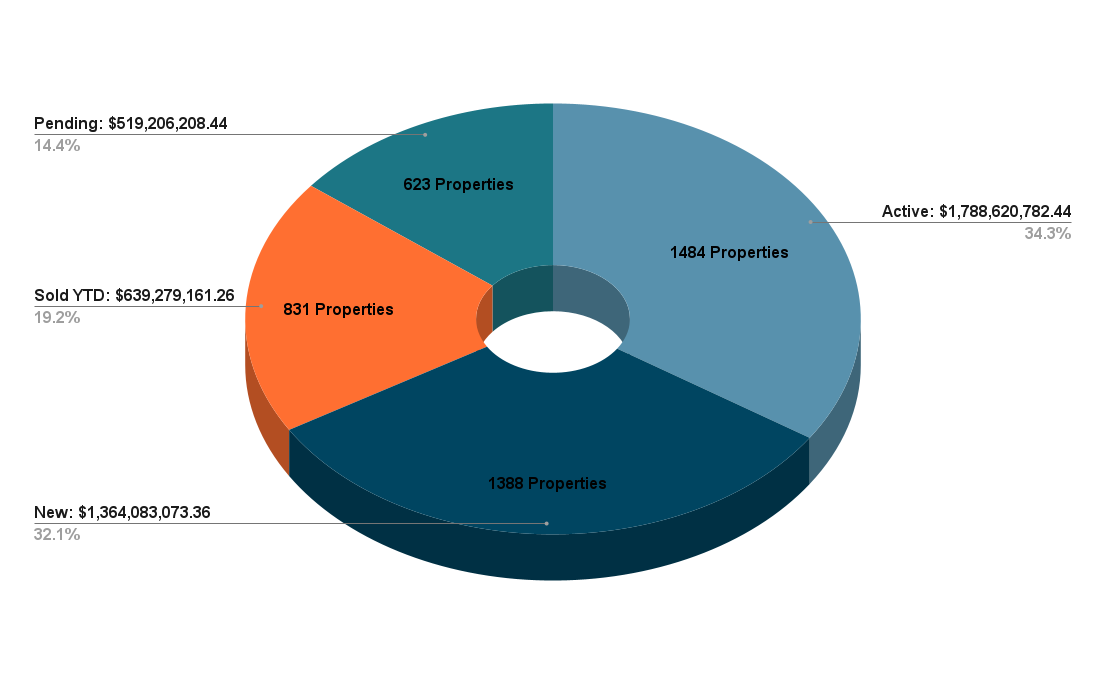

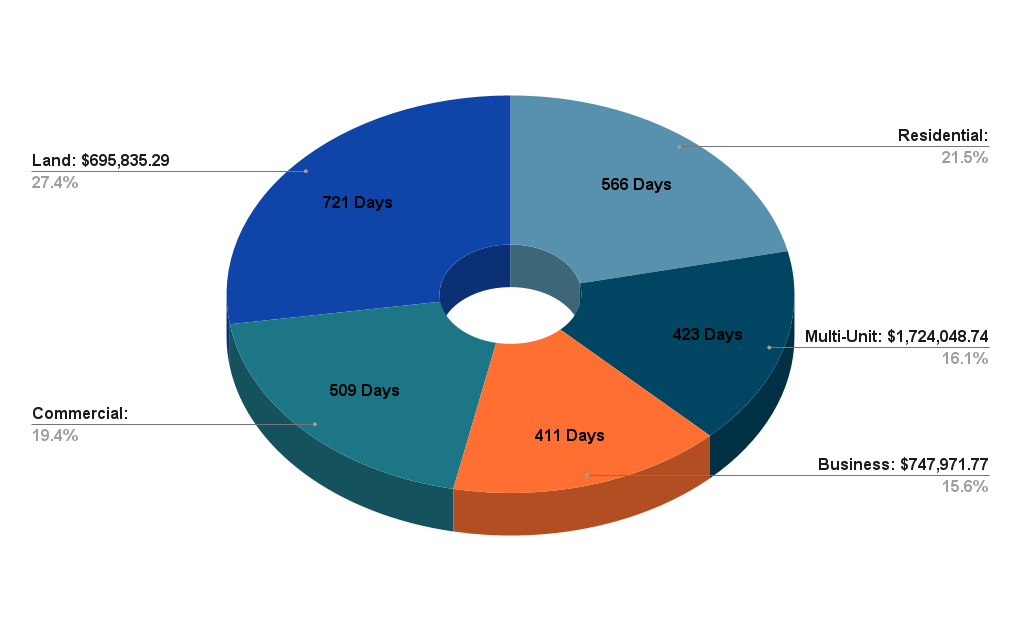

The Cayman Islands Real Estate Brokers Association (CIREBA) proudly presents the annual Property Market Update for 2019. As in previous years, this review delves deep into the performance and trends of the Cayman Islands' vibrant real estate landscape. 1. Year-on-Year Stability: In a striking observation, the figures for properties pending, sold YTD, and new listings remained unchanged from 2018 to 2019. This could indicate a stable demand-supply equilibrium, with equal interest from both buyers and sellers. 2. Time on Market Insights: In 2019, there was a noticeable reduction in the time properties remained on the market in nearly all segments compared to 2018. For instance, land listings decreased from 996 to 721 days. This could be indicative of an increased interest or more aggressive marketing strategies, leading to quicker sales. 3. Pricing Dynamics: There were variations in pricing across different property types. Most notably, the commercial segment experienced a surge in average listing price in 2019 ($5,512,266.24) compared to 2018 ($1,683,105.85). Such a spike could be attributed to increased business investments or premium commercial property listings. 4. Market Highlights: The unchanged sales figures year-on-year were unique, hinting at a market that found its equilibrium. Moreover, the commercial property segment's drastic price surge demands a deeper analysis – potentially indicating a shift in the types of commercial properties available or the regions where they were situated. The Cayman Islands' property market in 2019 painted a picture of stability and consistent interest. While sales figures mirrored the previous year, the dynamics of time on market and pricing fluctuations showcased an evolving market landscape. As the region continues to thrive, these insights will be crucial for investors and realtors alike in anticipating future trends.Key Figures

Number of Properties 2019:

Active Listings Average Time on Market 2019:

Observations and Comparisons: