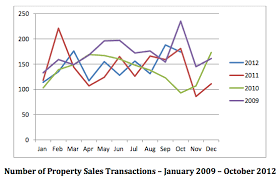

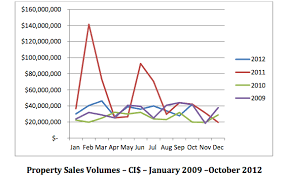

Real estate activity for the period January through October 2012 shows an overall drop compared to the same period in 2011. Due to the unusually large sale of Dart property in early 2011, the comparison between 2011 and 2012 is somewhat distorted. However, 2012 has achieved growth over 2009 and 2010, showing that the market is continuing to grow in line with normal activity. Sales dollars for January through October of the past four years are 2009:$340,854,786, 2010:$258,999,572, 2011:$581,291,696 and 2012:$361,889,900. The 2012 total through October exceeds the 12-month total for 2010, indicating that 2012 overall will likely be an improvement over both 2009 and 2010. Similarly, the average sales price per transaction has jumped significantly from 2009:$196,006 and 2010:$186,465 to 2012:$245,516 for January through October figures. The irregular year of 2011 averaged $384,707 for the same period. The figures for number of transactions are similar in pattern to the figures for sales dollars. 2009 was the high year with 1,739 transactions from January to October, even topping 2011 which had 1,511 transactions. 2010 saw 1,389 transactions for the same period and 2012 had 1,474 at the end of October. The Cayman Islands Government experienced budget difficulties in 2012. To address the significant shortfall from declining revenues, the Government took several measures to increase revenues. For one, Government increased stamp duty on real estate transactions to 7.5% across the board, up 1.5% for all locations other than Seven Mile Beach. Government also increased the charge on property insurance from a flat rate of $12 per policy to the new charge of 2% of the cost of premiums. In August Government announced it would also raise revenues by imposing income tax on expatriate employees. This move met with strong opposition and was eventually withdrawn. Real estate activity in September and October did not seem to suffer from this threat. However, the industry is still awaiting November and December figures to see if even the mention of such drastic measures will affect property sales. In December, the Premier was arrested on breach of trust and theft charges, an event which caused changes across the political landscape. The business community has commended the actions of law enforcement as evidence that the country’s legal system does not tolerate corruption or unethical activities. Statements from Government continue to appear in the news regarding the airport redevelopment and the cruise ship harbour redevelopment. However, reports on these projects are not substantive and neither project has seen any meaningful progress. In contrast, progress is noticeable in two of the three major commercial developments that many in Cayman see as critical to vigorous real estate activity. The ForCayman mega- project is moving forward with the redevelopment of the Courtyard Hotel and adjacent beachfront area as well as the re-direct of West Bay Road via the extended bypass. The Shetty Hospital project is also moving forward in methodical fashion. Though timelines have been extended, the development is taking shape and progress is quantifiable. Cayman Enterprise City also continues to make favourable announcements, though construction of the business campus has not commenced. In general, real estate sales figures for 2012 are encouraging. And the continued progress in the diverse slate of commercial projects bodes well for future growth of the real estate market. Jeanette Totten – President2012 Political and Economic Factors

Commercial Developments